Here's how to scrap the cuts to Winter Fuel Payment

Labour should restore Winter Fuel Payment for everyone in retirement, paid for by a levy on private pensions

The weekend press was full of speculation that Labour will reverse or water-down its cuts to Winter Fuel Payment. Ministers are right to be looking at this for political reasons. In focus group after focus group the withdrawal of WFP is the first thing people mention when looking for reasons to criticise the government.

But ministers are also right because the cut is very poor policy. It was applied to every pensioner except those on means-tested pension credit and universal credit. However before the cut was made only 12 per cent of the 1.9 million pensioners in poverty were on these benefits.1 The entitlements have low take-up; and many retirees with a state pension live in poverty but do not qualify for them. The post-2016 state pension system is deliberately designed so that means-testing is unnecessary unless you are caring, disabled or renting.

In welcome news almost 50,000 more households than usual successfully applied for pension credit in the months following the WFP announcement. But more than 1.5 million poor pensioners lost out on an essential source of support for winter bills.

Finding a solution

It is said that ministers are considering either simply reversing the cut; or keeping it but expanding the low income group who can still get WFP.

Both of these are bad ideas.

Labour would be crazy to invent a new means-test to determine who can receive a payment worth around £3 per person per week. It would be an administrative nightmare. What data would be used? What IT system? How would declarations be validated? Would it be withdrawn by cliff-edge or taper? What about take-up?

Eligibility last winter was deliberately based on ‘passporting’ people, based on their existing entitlements, because DWP knew who they were and how to pay them. The department excluded recipients of means-tested housing benefit because its systems did not interface with this locally administered benefit.

If that was the limit of the DWP’s operational capability last year how could it now possibly design and implement a new means-test unconnected to existing benefits? The only source of income data comes from the tax system. But this records personal incomes while WFP is a household-based benefit. A standalone means-test for WFP feels like a non-starter.

Nor can Labour simply reverse the whole policy without raising the money in some other way. Partly this is because it would send out the wrong message about fiscal rectitude. But a government can always find £1.5 billion to cancel a policy if it is truly toxic.

That’s not the real problem. The problem is the disability benefit cuts. There is simply no way that ministers can restore money to rich pensioners while slashing the incomes of disabled people unable to work. Labour MPs would not accept it.

Any reprieve for higher income pensioners cannot appear to be funded by poor disabled people of working age. There is another way however. The government can restore winter fuel payment but at the same time raise new money from older people who can afford to pay.

A small levy on private pensions

The answer is to levy a small slice of National Insurance on private pensions. At the moment private pensions are exempt from National Insurance whilst in payment. Employer pension contributions are also exempt from NICs when they are made. This means that more than half of pension income is never liable for NI at all.

A small levy of 1.5% of private pension income would raise around £1.6 billion.2 This is roughly the same as the government will lose if it scraps the WFP cut.3

The levy would mean people losing £15 per year from £1,000 of private pension income or £150 per year from £10,000. For comparison, the average pensioner who did not quality for WFP this winter lost £170. So under this alternative policy, people would have fared better last year unless they had an annual private pension worth more than around £11,300.

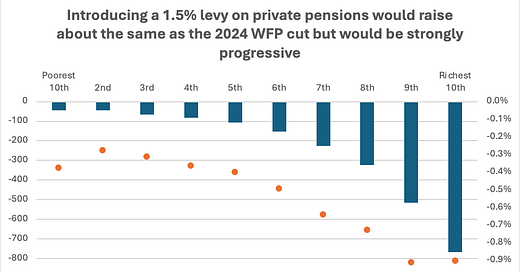

The chart shows the average net effect of restoring WFP and introducing the 1.5% levy for individuals in different income brackets. Pensioners with personal incomes over around £23,000 are worse off. Those with less are better off.

Source: Profit, employment and pension income, 2022/23, HMRC

This plan winds back the clock to last July and instead of scrapping the WFP introduces a progressive tax. You can see the effects at household level in the second chart, which retains WFP for all pensioners and adds the new levy. The average loss per retired household is around £230 which is similar to the average decline in household income caused by the WFP cut. But the poorest fifth of retired households lose less than £50 per year on average while the richest tenth lose almost £800.

Source: Effects of taxes and benefits on UK household income, 2022/23, ONS

This is paying for a universal entitlement through progressive taxation; the same way we fund the NHS. Immediately it would be roughly revenue neutral for the Treasury. But over time it would be positive if ministers continued to freeze the WFP in cash terms, while revenue from the levy increases each year in line with rising private pension incomes.

The levy also starts to address the ‘under taxation’ of wealthier pensioners compared to younger peers with identical incomes, which is mainly driven by the absence of National Insurance on their non-state income. Operationally the plan is straightforward as the money could be taken alongside the income tax already levied on private pensions.

Ministers cannot reverse the WFP cut for wealthy pensioners while slashing disability benefits for millions of people. They cannot invent a new means-test for the WFP to spare more low income pensioners. But they can share wealth better amongst people in retirement.

They should levy National Insurance on private pensions and use it to pay for the winter fuel payment.

Households below average income 2022/23, DWP stat-explore

Estimate for 2022/23 using both HMRC statistics on private pension incomes and ONS survey data from the Effects of Tax and Benefits on household income series.

Charging income tax on private pensions is fair because the retirees received income tax relief when they paid in. However, there is no relief on NIC contributions when someone pays into their pension. So, if the Exchequer were to charge NIC on income from the private pensions it would be double dipping.

Maybe, but that's surely not what National Insurance is (at least as it really exists). In any case, if NI is something you pay in order to get pension benefits - doesn't that strengthen the case for not charging NI on pensions?